Setting up a New PAP Plan

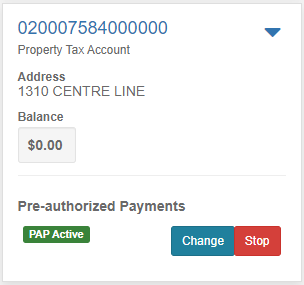

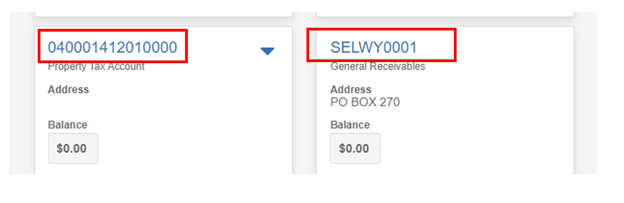

When you sign into your Virtual Town Hall account, for each property tax account you have you will see a 'Start' button in the Pre-Authorized Payment section.

- Click 'Start'

- Select either an existing bank account that you would have previously added or click the '+ Add New Account' button and add your banking information.

- Review the terms and conditions and the additional information before clicking 'Save and Accept'.

Note: If you have chosen a monthly plan, we will calculate your payment amount and email you a copy of the confirmation.

Changing an Existing PAP Plan

Change Banking Information

- Click the 'Change' and either an existing bank account that you would have previously added or click the '+ Add New Account' button and add your banking information.

Note: if you get an error when adding the bank account, click 'Back' button and click on 'Home' - your banking information will have been saved. You can then proceed to change your plan type, if desired.

Change the PAP Plan Type

- select a new plan type.

View Your PAP Plan Amount

There are three ways you can view your payment amount:

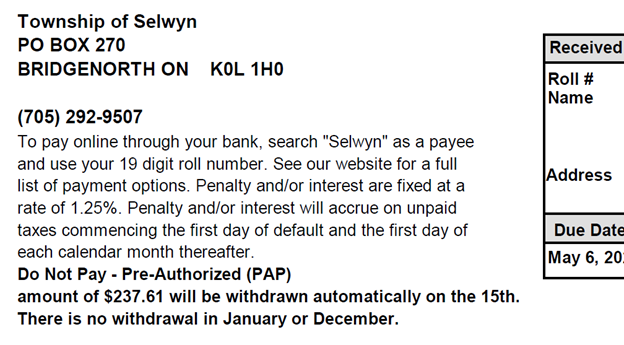

- If you were enrolled in PAP and received an electronic notification, the amount will be noted on your property tax notice. If you enrolled after the notices were generated, you received a calculation by email, mail or in-person at the Municipal Office:

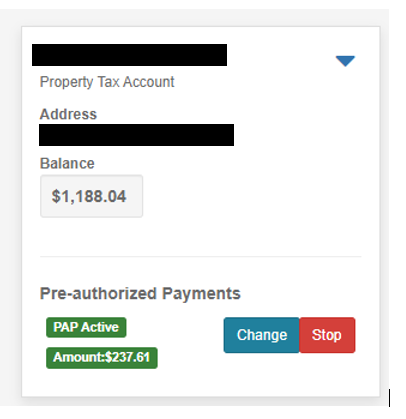

- On your Virtual Town Hall accounts listing page, the amount will show right under the 'PAP Active' message:

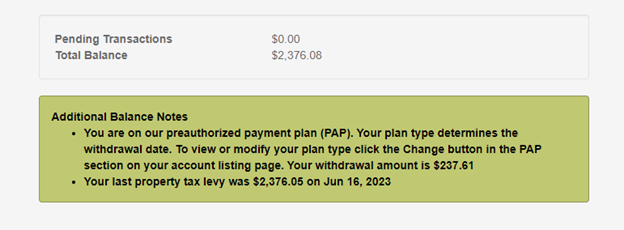

- To view your account Balances/Transactions, see the amount listed at the end of the Tax Year Summary section:

Cancel an Existing PAP Plan

Click 'Stop'