Note: For property tax & finance related forms, go to our Forms, Applications, Permits page.

2024 Tax Installment Due Dates

Installment due dates are the 1st Monday of March, May and October, and the 1st Tuesday of August:

- March 4, 2024

- May 6, 2024

- August 6, 2024

- October 7, 2024

If you are moving, or have changed your mailing address,

please contact us immediately.

The Tax Collector has no authority to waive or alter penalty and/or interest for any reason, including not receiving a tax notice.

| Municipal Property Assessment Corporation (MPAC) + Township of Selwyn | ||||||||||||||||||||||||||||||||||||||||||||||||

|

What is the relationship between your assessment and your property taxes? MPAC is responsible for assigning the assessment value and class for all properties in Ontario. For more information - including a link to their First-time homeowners' Hub, see the MPAC section of our website. The Township of Selwyn uses this information to set property tax rates and calculate the Property Tax Levies. Please read through the information below to learn more. |

||||||||||||||||||||||||||||||||||||||||||||||||

| Property Tax Notices | ||||||||||||||||||||||||||||||||||||||||||||||||

|

Annual taxes are calculated by multiplying the assessed value of your property by the Municipality's current consolidated tax rate. The consolidated tax rate is made up of a Township portion and a County portion (influenced by the respective budget requirements) and an Education portion which is set by the Province of Ontario. Through sound financial management, Selwyn boasts the lowest municipal property tax rate in the County of Peterborough. Interim Tax Notices are based on approximately 1/2 of the previous year's total tax levy. Interim Tax Notices are sent at the end of January, and Final Tax Notices are sent at the end of June. The Municipal Property Assessment Corporation determines the assessed value of each property. Included with all new owner tax notices:

Included with your 2024 tax notices: Interim: 2024 Interim Tax Insert, landfill site pass and Peterborough County Causeway Update. Final: 2024 Final Tax Insert

|

||||||||||||||||||||||||||||||||||||||||||||||||

| Paperless Billing with Virtual Town Hall (VTH) | ||||||||||||||||||||||||||||||||||||||||||||||||

|

You can receive a digital copy of your Property Tax Notice by signing up for Paperless Notifications. To access the digital copy, you will log into your Virtual Town Hall account. For more information, please see our paperless notifications page. |

||||||||||||||||||||||||||||||||||||||||||||||||

| Property Tax Calculation | ||||||||||||||||||||||||||||||||||||||||||||||||

|

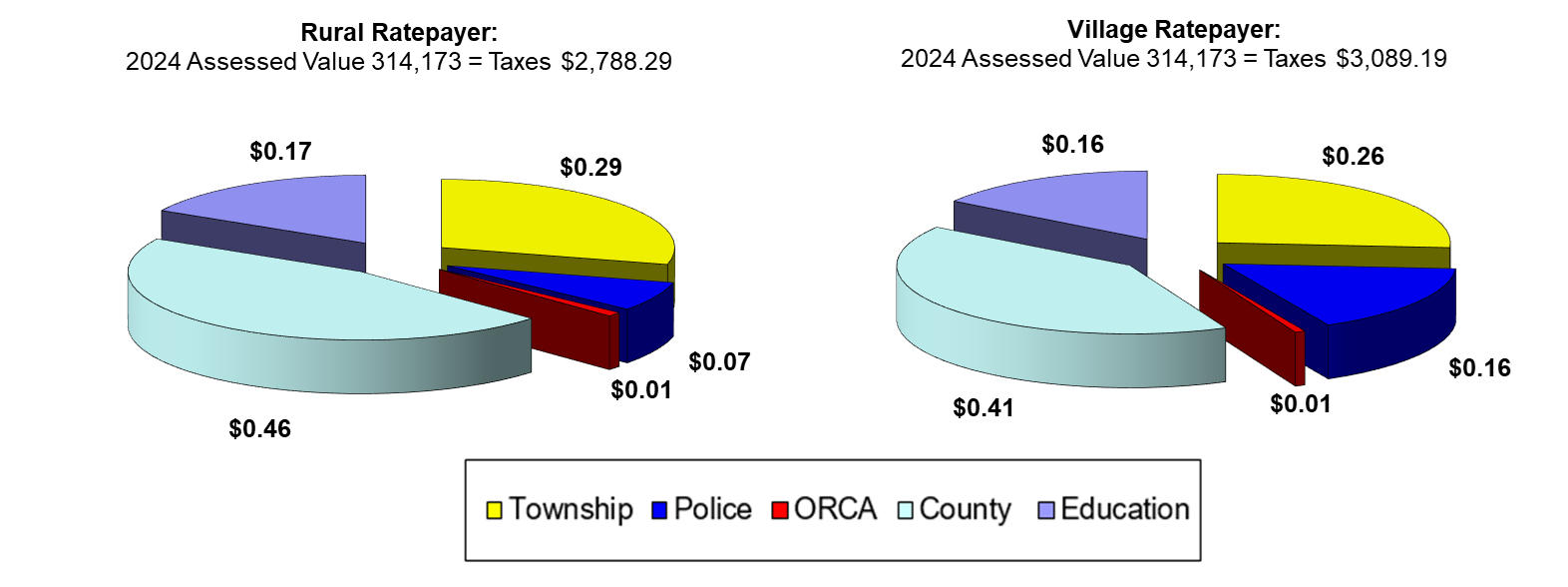

Want to determine what the annual taxes will be on a property? Simply multiply the assessment value and the tax rate. If the property is located in Woodland Acres, you will also need to add on the annual charges for water and wastewater. Don't know the assessment value? Use our Property Search through Virtual Town Hall (VTH) Examples: 2024 residential assessment of 314,173 located in Ward 1, 2 or 4: 314,173 x 0.887500% (or 0.00887500) = $2,788.29 2024 residential assessment of 314,173 located in Ward 3: 314,173 x 0.983277% (or 0.00983277) = $3,089.19

Comparison of 2023 Municipal Tax Rates to 2024 Municipal Tax Rates |

||||||||||||||||||||||||||||||||||||||||||||||||

| Property Tax Reminder Notices | ||||||||||||||||||||||||||||||||||||||||||||||||

|

For the remainder of 2023 and all of 2024, Property Tax Reminder Notices for outstanding balances will only be sent after an installment due date and at the end of the year. Staff will be investing the existing resources into property specific discussions, rather than monthly mailings to all eligible properties. This collection process will be reviewed later in 2024 with respect to cost savings and effectiveness.

Penalty and/or interest is fixed at a rate of 1.25% per month and will continue to be added to unpaid taxes after the due date and the beginning of each month after. Reminder notices will be sent for accounts with an outstanding balance over $10.00 at the beginning of March, May, August, October, and December.

Balances can be viewed 24/7 through your Virtual Town Hall (VTH) account or can be requested by contacting the office by phone: 705-292-9507 or by emailing the finance department. |

||||||||||||||||||||||||||||||||||||||||||||||||

| Penalty & Interest | ||||||||||||||||||||||||||||||||||||||||||||||||

|

Penalty and/or interest is fixed at a rate of 1.25% per month and will be added to unpaid taxes after the due date and the beginning of each month after. Reminder notices are sent 5 times a year for accounts with an outstanding balance over $10.00. |

||||||||||||||||||||||||||||||||||||||||||||||||

| Payment Options | ||||||||||||||||||||||||||||||||||||||||||||||||

| Property taxes can be paid by pre-authorized payment plan, online/telephone banking, cash, debit or cheque. For details, please see our Payment Options and Information page. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Payment Apply Sequence | ||||||||||||||||||||||||||||||||||||||||||||||||

As required by the Municipal Act, 2001 s 347(1) all payments are applied in the following order:

|

||||||||||||||||||||||||||||||||||||||||||||||||

| Current Municipal Tax Rates | ||||||||||||||||||||||||||||||||||||||||||||||||

|

Not sure whether your property taxes are based on the rural or village tax rate?

Not sure what ward you are?

2024 Consolidated Tax Rates

|

||||||||||||||||||||||||||||||||||||||||||||||||

| Tax Rate By-law and Schedules | ||||||||||||||||||||||||||||||||||||||||||||||||

| Water & Sewer | ||||||||||||||||||||||||||||||||||||||||||||||||

|

Properties located in the Village of Lakefield and Woodland Acres (including the new Summer Lane subdivision) are serviced by municipal water and wastewater. The Village of Lakefield receives a separate Water and Sewer Invoice from Selwyn Township, and Woodland Acres is billed by the Township under the "Special Charges" section of the interim and final tax notice each year. For current rates and billing information, please visit the Municipal Water & Wastewater page. |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Property Tax Statement for Income Taxes |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Looking for your annual taxes paid for income tax? Please see our Property Tax Statement for Income Tax page |

Distribution of 2024 tax dollar based on average residential assessed value

For a breakdown of the County dollar, visit the Peterborough County website

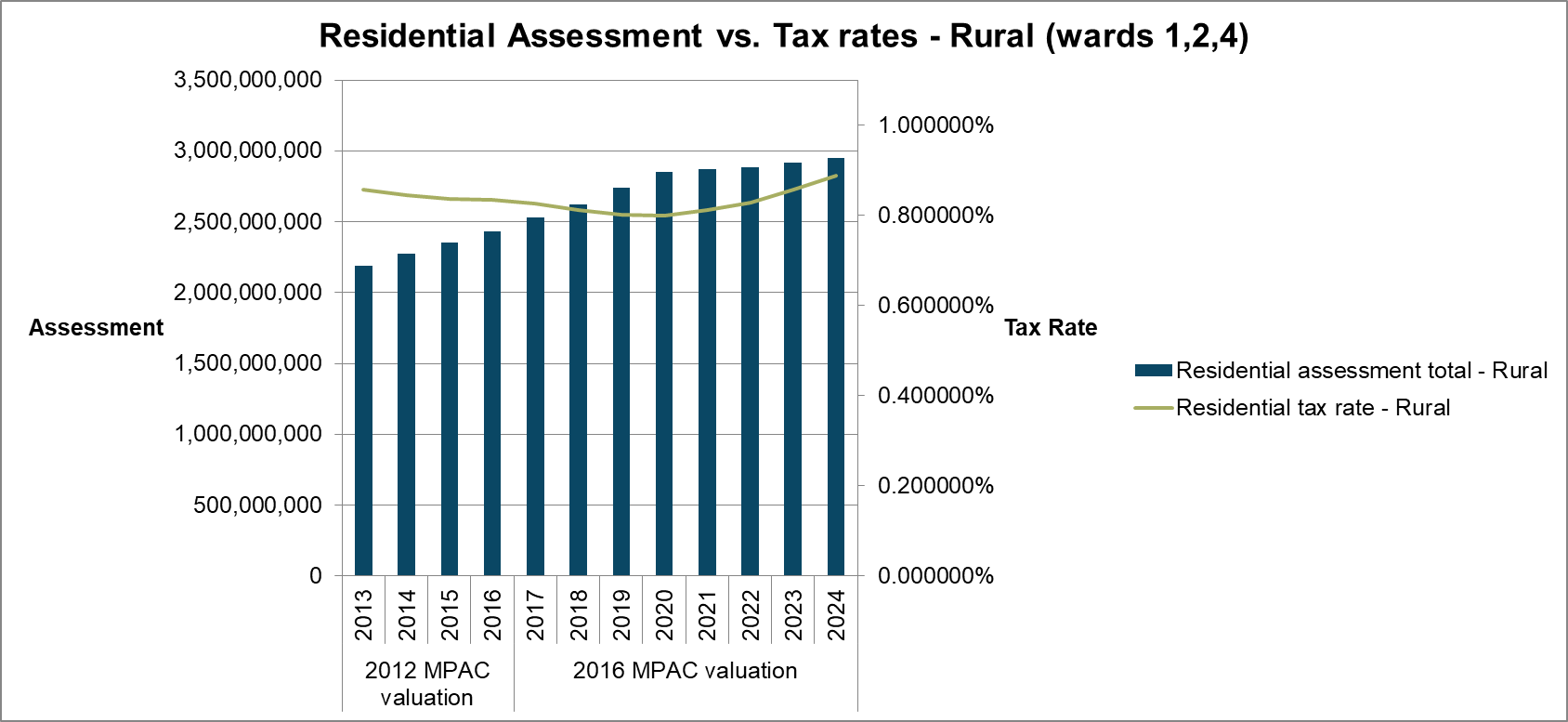

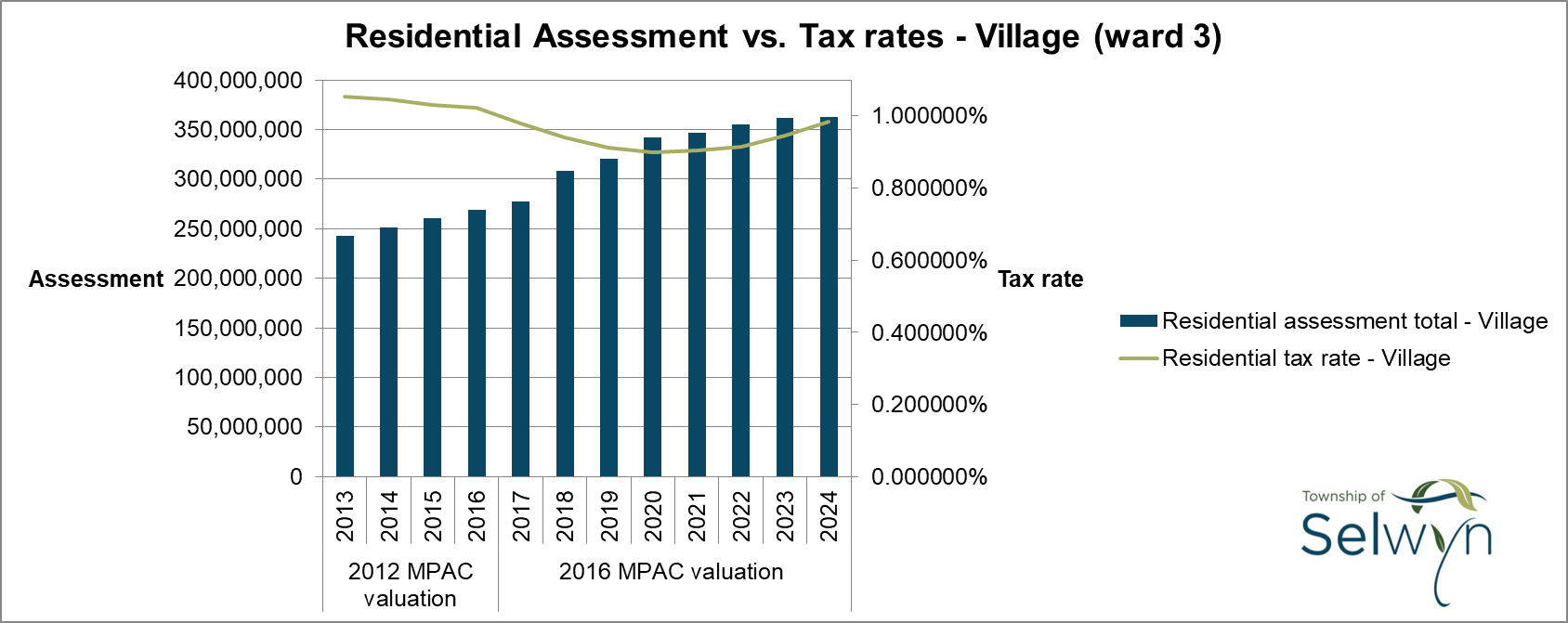

Relationship between total residential assessment and residential tax rate

Note: the Ontario government has postponed the 2020 Assessment Update. They have indicated that property assessments will continue to be based on the fully phased-in January 1, 2016 current values. For more information, visit MPAC's website.

Contact Us